What can NYC taxi drivers teach us about working remotely?

Getting to know our cognitive bias to work smarter

First Part.

In a well-known study conducted in 1997, Colin Camerer and colleagues showed that New York City taxi drivers – and presumably all humans under the same conditions – tend to work more on sunny days, even though there are fewer customers, and less on rainy days, when the alternatives to work are less attractive and it’s easier to make money because there are many more customers looking for a cab. But what can NYC taxi drivers teach us about working remotely?

Since the beginning of the pandemic, and after the peak that Italy recorded in March 2020, at the beginning of their lockdown, Italians massively began searching Google about “Smartworking”, the term now commonly used in Italy to refer to working from home, whereas other countries continue to favor “remote working”. [Google Trends, 2021].

However, while the term smartworking may be used by many Italians in order to denote “working from home”, simply working from one’s home is not enough to make one’s working experience “smarter”.

The first data of an ongoing survey run by the Observatory on Smartworking and Trust within Organizations of the University of Chieti-Pescara’s Department of Neuroscience show that, as Italian workers accumulate experience and, therefore, spend time working from home, they are starting to ascribe different meanings to the term “smartworking”.

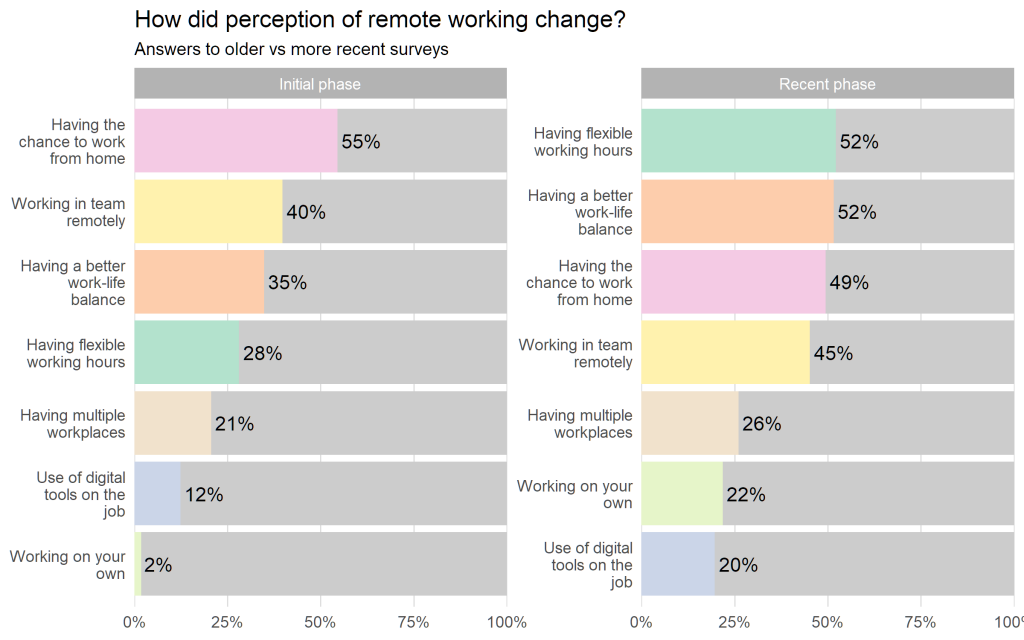

(In the following data and graphs, the sum exceeds 100 because participants had the possibility of expressing more than one preference).

At the beginning of the pandemic, 55% believed that smartworking meant primarily “working from home” or working remotely (40%), while only 35% perceived it as a way to better balance work and personal life, and only 28% viewed it as having flexible work schedules; today, data show us that the trend is now reversed.

Having flexible work schedules and work-life balance now rank first (both reported by 52% of participants as being the main characteristics of smart working), while working from home or remotely have dropped to third and fourth place, losing 6 and 5 percentage points, respectively, if compared to responses collected back in June and July 2020.

At the same time, the second part of the Smartworking and Trust survey shows how the importance of “time management” among the skills considered relevant for working remotely has increased from 83.6 to 87.9 points out of 100, thus overtaking soft and hard skills that would be intuitively ascribed to remote working, such as interpersonal and digital ones.

So what is it that makes our work truly smart?

And what is restraining us from doing it?

With this article, I want to initiate a reflection on how behavioral economics can help us answer these questions.

There is no doubt that one characteristic of smart work is flexibility in time management. In order to maximize their usefulness, people should work more in the periods when their work output is higher (it wouldn’t make much sense to go fishing at times when we know that the fish aren’t biting, right?) and when there are lower opportunity costs (fewer alternatives to give up).

In the latter sense, unfortunately, the pandemic has produced a side effect: there is a working overload (for those lucky enough to still have their job) due to the fact that, when in lockdown, there are very few alternatives to work. We cannot go for a walk, we cannot meet with a friend, we cannot go to the movies and, even on weekends, sometimes the only activity left seems to be working.

So, let’s go back to our example of the “economically irrational behavior” of the New York taxi drivers. Why do they work more on sunny days and less on rainy ones?

A first explanation is related to mental accounting. We create a set of financial reference points in our minds to keep track of both our sources of income and the possible ways of spending it. In fact, it has been shown that we all have a great accounting system in our minds, as if we were professional accountants. Although rational economics considers it a fungible asset par excellence, the value we assign to money can vary according to its source, place of storage and destination. For example, many will have experienced that an extraordinary income (such as a winnings or an inheritance) is often destined for equally extraordinary expenditures (a vacation, a new car, etc.). There are also many who have overdraft debts on their current account or credit cards, which generate high interest charges, while at the same time holding sums in deposit accounts which do not result in significant interest earnings.

A point of reference, in this case, is a mental budget, which is a sort of self-defense against a lack of self-control, like the strategy implemented by Ellie and Carl, the lead characters of Disney- Pixar’s movie “Up”.

They keep putting money in jar to avoid spending it, in view of a rewarding goal, specifically a much longed for trip. Similarly, when leaving home in the morning to go to work, New York taxi drivers have a budget in mind, a revenue goal, that – once reached – immediately drops their working motivation and effort or, more specifically, the energy one is willing to exert at work.

What happens with reference points is that one euro (or one dollar) less is experienced as a loss, while one euro more is experienced as a gain, but we perfectly know, thanks to studies in loss aversion, that we suffer for a loss much more than we rejoice for a gain of the same magnitude.

This is why taxi drivers keep persevering on difficult sunny days by working harder and finding the very few who need a cab, while they don’t work as hard as they could on rainy days once having reached their mental budget much more easily.

A second explanation is related to our human difficulty in seeing opportunity costs. There is a real blindness toward this crucial category of costs. An economic decision is a choice between different alternatives when deciding to use a scarce resource, such as time, for example. When we choose between different alternatives and we decide how to spend it (working, playing, etc.), we are, at the same time, also picking the alternatives that we will need to give up. In this sense, the opportunity cost is the very essence of an economic decision: it is, indeed, what gives value to the economic decision. Among all the alternatives that we give up, the one that has the highest cost (e.g. giving up the time spent with our loved ones because we devote more time to work) is what will determine the opportunity cost.

The taxi drivers of New York – like all human beings – experience a difficulty in seeing the opportunity cost when comparing the gain they can obtain from working a bit more with the cost they must sustain and in considering the visible part of that cost (having to drive a car in city traffic for a given time). They will ignore, or put less weight on, an equally important, but less visible, part of the total cost (the gain opportunities they are giving up).

These are just a few examples of how cognitive biases can quite naturally prevent us from working smarter.

An important part of behavioral economics studies these biases, the heuristics that cause them, and ways to reduce their effects or employ them for public benefit (e.g. nudging).

The research program on heuristics and bias was started by Daniel Kahneman and Amos Tversky (the story of their scientific journey is masterfully unfolded in The Undoing Project) and played a crucial role in setting the bedrock of Behavioral Economics.

The seminal work on prospect theory – for which Kahneman earned the Nobel Prize in Economics in 2002 (sadly Tversky had already prematurely left us) – is certainly represented by the aversion to loss that we have briefly mentioned. This is yet another human tendency to make systematic mistakes that inevitably affect the way we work, and relate to others at work.

There are other ways in which loss aversion can prevent people from making work smarter. Knowing them is the best way to remove this brake.

How?

We’ll talk about that in the next article!